The government’s new capital allowance ‘Super-Deduction’ hopes to boost business investment and productivity, but good planning and record-keeping are essential for businesses hoping to take advantage.

The Super-Deduction is only available to limited companies, it is not available for Sole Traders or Partnerships.

What are capital allowances?

Capital allowances let taxpayers write off the cost of certain capital assets against taxable income, taking the place of accounting depreciation (which is not normally tax-deductible), and therefore businesses can deduct capital allowances from their taxable profits.

From 1 April 2021 until 31 March 2023, limited companies investing in qualifying new plant and machinery assets will be able to claim:

- A 130% super-deduction capital allowance on qualifying plant and machinery investments

- A 50% first-year allowance for qualifying special rate assets

The Super-Deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

This will mean that on a spend of £100,000, the corporation tax deduction will be £130,000, giving corporation tax relief at 19 per cent on £130,000, which is £24,700.

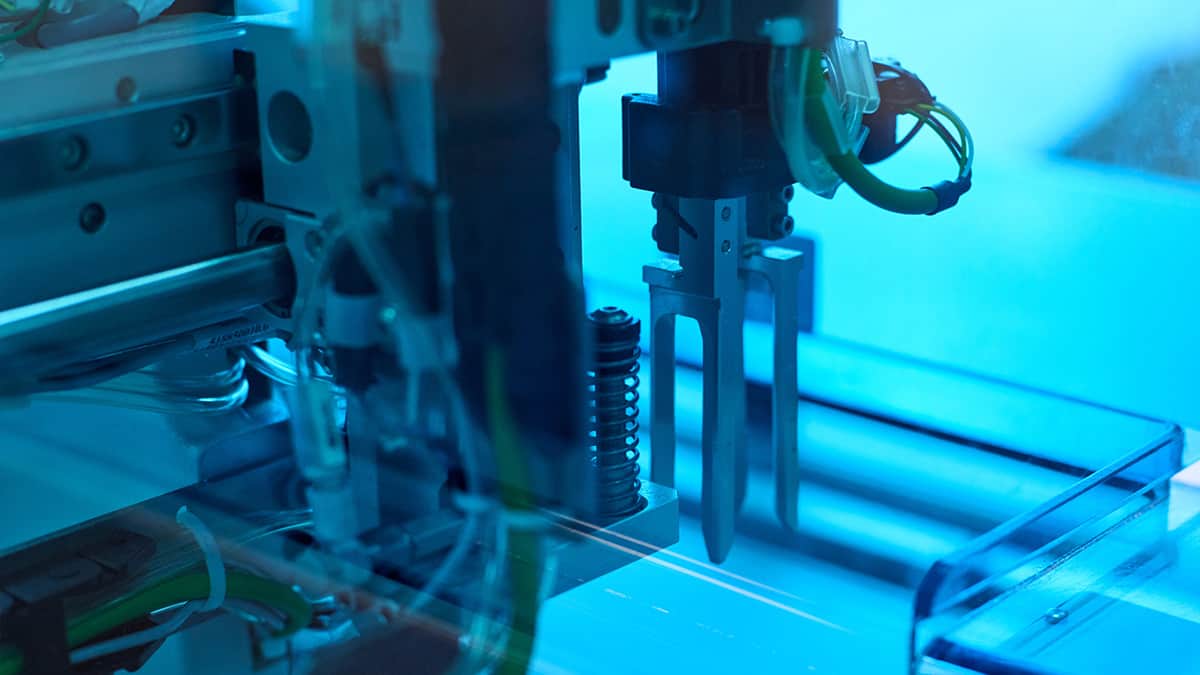

What is plant and machinery?

Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances.

There is not an exhaustive list of plant and machinery assets. The kinds of assets which may qualify for either the super-deduction or the 50% First Year Allowance include, but are not limited to:

- Solar panels

- Computer equipment and servers

- Tractors, lorries, vans

- Ladders, drills, cranes

- Office chairs and desks

- Electric vehicle charge points

- Refrigeration units

- Compressors

- Foundry equipment

Further key points:

- The expenditure must be incurred between 1 April 2021 and 31 March 2023

- There is no upper limit to the level of expenditure that attracts this enhanced relief

- Excludes plant and machinery for leasing (including landlord fixtures within rented property)

- Excludes cars

If you are looking to purchase plant and machinery and are unsure if you have the appropriate cash reserves, please contact us on 01249 465435 for our Chippenham office and 01793 378586 for our Swindon office.

Share this Story